To invest in a property is just one of the biggest choices from inside the anybody’s lifetime and you will a good capital too. Stepping into an alternate family and you will keeping that which you prime was a beneficial dream for some. However, buying a dream household really should not be a monetary headache to you. Well, within this scenario, a mortgage on the net is a great brand of financial assistance while brief to the bucks or otherwise not throughout the disposition out-of doing their savings.

Whether you’re waiting around for to acquire another type of house, the lending field also offers many financing opportunities which can be worthwhile and you can helpful. Over the years, tech has evolved a few things for the credit business. Into quick and easy financing recognition techniques, it will become smoother to acquire a house of your preference. All you need to see is your real conditions and a great piece of personal loans online New Mexico information about the mortgage procedure to create your fantasy family. While you are not used to it funds business, here is what you should know before-going ahead toward financial procedure that make the feel stress-free!

See the Assets Venue

Everyone would like to purchase a home regarding the top location, towards best surroundings and features to be able to label a put your individual. So before you could proceed to the loan process or conduct a home, definitely browse the put two times as its a great one-day financial support. Our home you are looking at is within the safe locality which have all of the basic establishment such as for instance health, sector, college, school, workplace things are nearby. This makes your daily life convenient and you can hassle-100 % free.

Time and energy to Look at your Credit history

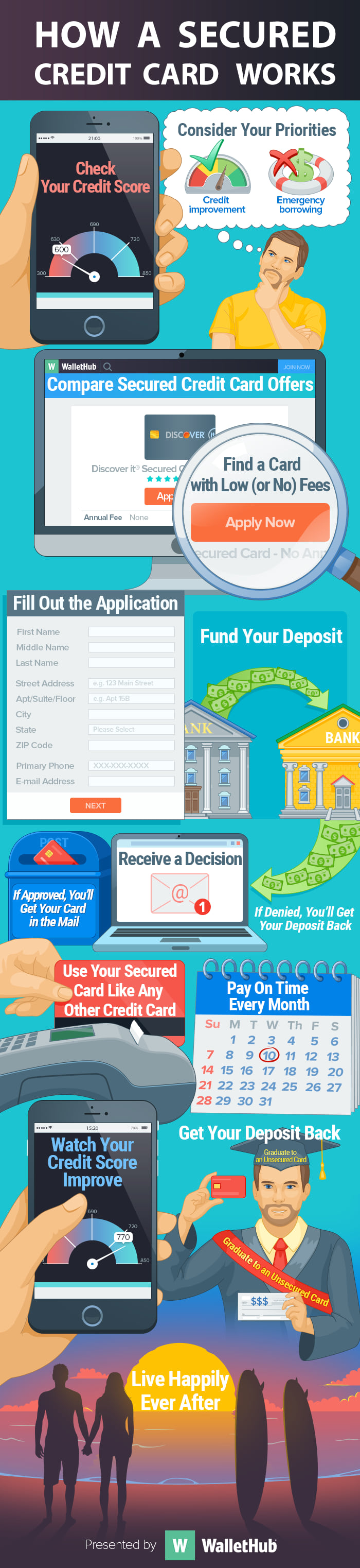

Before you apply to possess a houses financing, it’s extremely essential to look at the credit score as it takes on a vital role from inside the giving your loan app. That have good credit such as 750 or more can assist you have made a lower interest loan. But if you don’t possess a rating, you could nevertheless raise they and apply for a financial loan. Eg paying down your expense, EMIs, and credit card bills punctually will help you in the improving the rating.

Compare Before you apply

When you start trying to get a home loan on the internet, don’t simply settle for the original bank your connect with. Perform proper search and look for several lenders, examine its mortgage keeps and you will rates, and according to your benefits, select one to.

Check out the Interest levels

When you get home financing on the internet, the pace was a primary question to search for. Other lenders provide fixed and you will drifting costs. In the drifting costs, interest levels are instantly modified as per market criteria and you will fixed cost dont changes. The interest costs getting mortgage brokers can differ out-of lender to help you lender otherwise away from standard bank to help you lender, very be careful regarding the speed and you may repayment period, after which use.

Verify Regarding the Monetary Urges

You ount of financing than simply need but you don’t need to take it. Before applying, make sure you can also be pay the quantity punctually without any issues since you have to make an advance payment also. It is therefore crucial that you recognize how much you would like, period several months, and EMIs just before moving on. As well as whenever you are trying to get a home loan online, go through the adopting the costs also processing costs, possessions fees, legal or other costs.

Listing for Obtaining a property Mortgage

- How old you are is between 21 to help you 65 decades

- Are salaried otherwise notice-working

- The fresh applicant will likely be a keen Indian resident

- Make an effort to add an effective co-candidate that can create your mortgage recognition simpler when you are to make sure lower rates of interest

Delivering home financing has grown to become Easy that have Pal Financing

Likely to move into a special household? But no strong financial hand to be of assistance. No need to stress while the Pal Financing, among the best mortgage aggregators has arrived to help you score a loan efficiently and you will effectively. Away from 1000 so you can 15 Lakhs, you can get that loan as per your circumstances which have an excellent down interest rate performing within % p.a beneficial. you rating a flexible repayment period you to range from step three days to 5 years. Therefore be ready to purchase your dream domestic today.

Detail by detail Recommendations to own Implementing Mortgage

- Before deciding to your lender, you must compare and examine your loan requirements, qualifications conditions, credit rating, or any other activities.

- Go through the interest, installment techniques, and financing period that can make your financing control sense top.

- When you go after an informed bank, it’s time to fill up the loan application and you may complete it. Now the process is extremely simple and easy simple as you are able to take action online and requires minimal documents.

- Immediately following submitting the desired financial records and other one thing, the loan supplier usually be sure what you, finalize the borrowed funds amount, and name one render more information.

- Plus the final step is actually disbursal. The fresh accepted count would-be credited for your requirements and you also can be proceed with the plans of getting a property.

Availing to own a mortgage is easy nowadays. Conference all standards and having the data can make your loan acceptance process simpler. As to the reasons wait? Sign up for financing on the web today and get your ideal home today!

Download Consumer loan App

Shopping for a quick financing? Buddy Mortgage makes it possible to get an instant financing on best RBI-acknowledged loan providers. Download the Pal Loan Application on the Play Store otherwise Software Shop thereby applying for a loan now!