- Take note of the eligibility requirements and you can value prior to getting a second assets.

- The latest current rise in A lot more Consumer’s Stamp Obligation (ABSD) means might you need much more dollars when selecting a second house.

- To purchase the next property has a great deal more financial responsibility; its told to-be obvious regarding the goal for selecting another possessions

That have rising cost of living dominating headlines in the current weeks, interest levels are ready to increase subsequent on future weeks. For those who have become probably and obtain an extra property, this can be a great time first off looking once the a good rise in interest rate may indeed suggest stabilisation out of assets cost.

Aside from the expense of the house or property, there are things you’ll must be aware of whenever to find one minute house, including qualifications, value and you may intent.

Qualification

For those who very own an exclusive property, then you will be able to buy a second private assets without having any legal ramifications. Yet not, whether your very first property is a community houses, should it be a setup-to-Order (BTO) apartment, resale HDB flat, manager condo (EC), or Framework, Create and sell Design (DBSS) apartments, then you’ll need certainly to complete particular criteria in advance of bad credit loan Cleveland you buy.

HDB flats incorporate good 5-year Lowest Profession Period (MOP) specifications, and thus you would need certainly to invade that property to possess a great the least 5 years before you promote otherwise rent the apartment. you will need certainly to fulfil this new MOP before the buy out-of an exclusive property.

Carry out note that merely Singapore citizens can own each other an HDB and a personal property meanwhile. Singapore Long lasting Customers (PRs) will need to move out of the apartment within 6 months of the personal possessions purchase.

Value

Homes are recognized to become notoriously pricey from inside the Singapore and you can careful computations need to be designed to ensure that your next possessions get stays sensible for your requirements. You would have to take notice of your following the:

You’ll need to pay ABSD once you purchase an extra domestic assets. The total amount you’ll need to pay utilizes your own character.

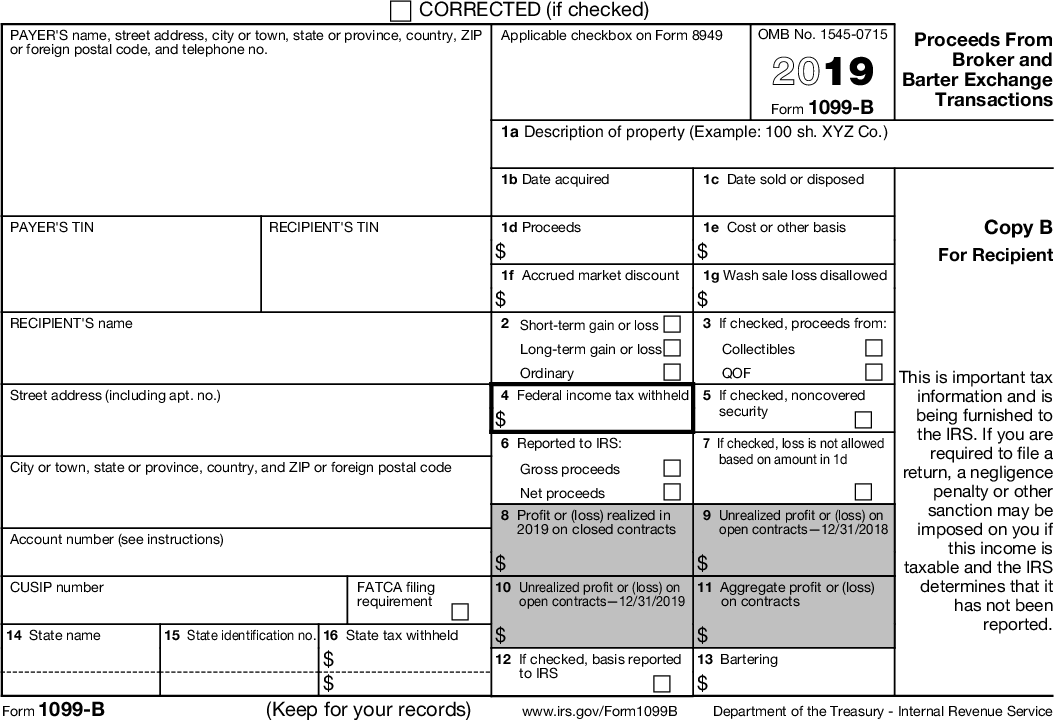

This new ABSD was past modified into the as part of measures so you’re able to bring a lasting possessions markets. Current cost was reflected on table lower than:

Given the newest ABSD prices, a great Singapore Resident whom currently possesses an enthusiastic HDB apartment but wants to shop for a personal condominium charging $one million has to fork out an enthusiastic ABSD of $two hundred,000 (20%). Perform remember that it count is found on top of the buyer’s stamp duty.

Very first house get demands just doing 5% dollars downpayment if you took up a financial loan, your second assets requires a 25% cash advance payment of your property’s valuation maximum. Provided a house that’s respected at $one million, you’ll you need $250,000 cash having down-payment.

The entire Debt Repair Ratio (TDSR) structure try lead on to stop home buyers out of borrowing from the bank too far to finance the acquisition out-of a property. According to the construction, home buyers could only obtain so you’re able to up 55% (modified to the ) of the disgusting monthly income.

When you yourself have a home loan associated with very first assets pick, it can greatly affect the amount you can obtain to suit your second home. But not, when you have currently cleaned the borrowed funds on the basic family, then you’ll definitely just need to ensure that your monthly housing mortgage money and additionally any other month-to-month bills dont exceed 55% of the month-to-month money.

For your first houses financing, youre permitted use doing 75% of the house really worth when you’re trying out a bank loan or 55% if for example the loan period is more than thirty years otherwise offers prior age 65. For the 2nd housing loan, your loan-to-worthy of (LTV) ratio drops to help you 45% having financing tenures around three decades. Whether your financing tenure surpasses 25 years otherwise the 65th birthday, their LTV falls in order to 31%.

As you can plainly see, to buy a second possessions if you are nevertheless purchasing the loan out of your first family want far more cash. Considering a home valuation regarding $1 million, you will probably you need:

While it is possible to use your Central Provident Finance (CPF) to acquire the next assets, for those who have currently made use of the CPF to you personally very first domestic, you can only use the other CPF Normal Membership discounts for the second property shortly after setting aside the present day Very first Later years System (BRS) of $96,000.

Intent

To find an extra possessions comes with alot more economic responsibility compared to the first you to, and is also informed are obvious regarding your goal to own purchasing the second property. Could it be for funding, otherwise will you be utilizing it given that a moment household?

Clarifying the purpose will allow you to for making specific decisions, including the version of property, and choosing a location who would greatest suit its purpose. This will be particularly important in the event the next home is a good investment possessions.

Like most most other assets, might need certainly to work out the possibility rental yield and you may investment love, in addition to determine new estimated return on investment. Given that a house pick is an enormous capital, it’s adviseable to keeps a method you to consider circumstances such:

What is your investment views? Could you aim to bring in a revenue once 5 years, or perhaps to hold on to it into long-label to get rent?

Whenever and just how do you cut losings, if any? In case your mortgage repayments is greater than the lower local rental earnings, how much time do you really wait in advance of offering it off?

To shop for a property within the Singapore was resource-rigorous and purchasing a moment household requires far more financial prudence. People miscalculation can have significant financial outcomes. As such, put up an obvious plan and you can request an abundance think movie director to that have you’ll blind locations.

Start Believe Today

Listed below are some DBS MyHome to sort out this new sums and acquire a home that suits your budget and you can choice. The best part they incisions the actual guesswork.

Instead, prepare which have an out in-Idea Recognition (IPA), which means you have confidence about how exactly much you could borrow for your residence, letting you know your allowance precisely.